Sula Vineyards Limited

Please refer to important disclosures at the end of this report

1

Incorporated in 2003, Sula Vineyards Limited is the India's largest wine producer and

seller as of March 31, 2022. The company also distribute wines under a bouquet of

popular brands including "RASA," "Dindori", "The source," "Satori", "Madera" & "Dia"

with its flagship brand "Sula" being the "category creator" of wine in India. The

company's business is broadly classified under two categories (i) The production of

wine, the import of wines and spirits, and the distribution of wines and spirits (the

"Wine Business"); and (ii) The sale of services from ownership and operation of wine

tourism venues, including vineyard resorts and tasting rooms (the "Wine Tourism

Business").

Positives: (a) Experienced board and qualified senior management (b) Secured supply

of raw materials with long term contracts exclusive to Sula (c) Established market leader

in the Indian Wine industry with the leading brand “Sula” combined with leader and

pioneer of wine tourism business in India

Investment concerns: (a) Company benefits from high import duties imposed on

imports of international wines in India, these duties could be reduced or eliminated in

the future. (b) Adverse climatic conditions may impact the quality of wine grapes which

is the key raw material. (c) Company may not be able to adjust the retail prices of its

products as a result of state regulation.

Outlook & Valuation: In terms of valuations, the post-issue P/E works out to 52.5x

FY22 EPS (at the upper end of the issue price band) which is less than its indirect peers

like United Spirits, United Breweries Ltd and Radico Khaitan Ltd. Further, SVL has a

niche offering which peers don’t have much expertise in. However, its financials are

not much attractive at this juncture considering 10% yoy growth in net sales and along

with the fact that it has recently turned profitable. Considering all the factors, we

believe this valuation is at reasonable levels. Thus, we recommend a NEUTRAL rating

on the issue.

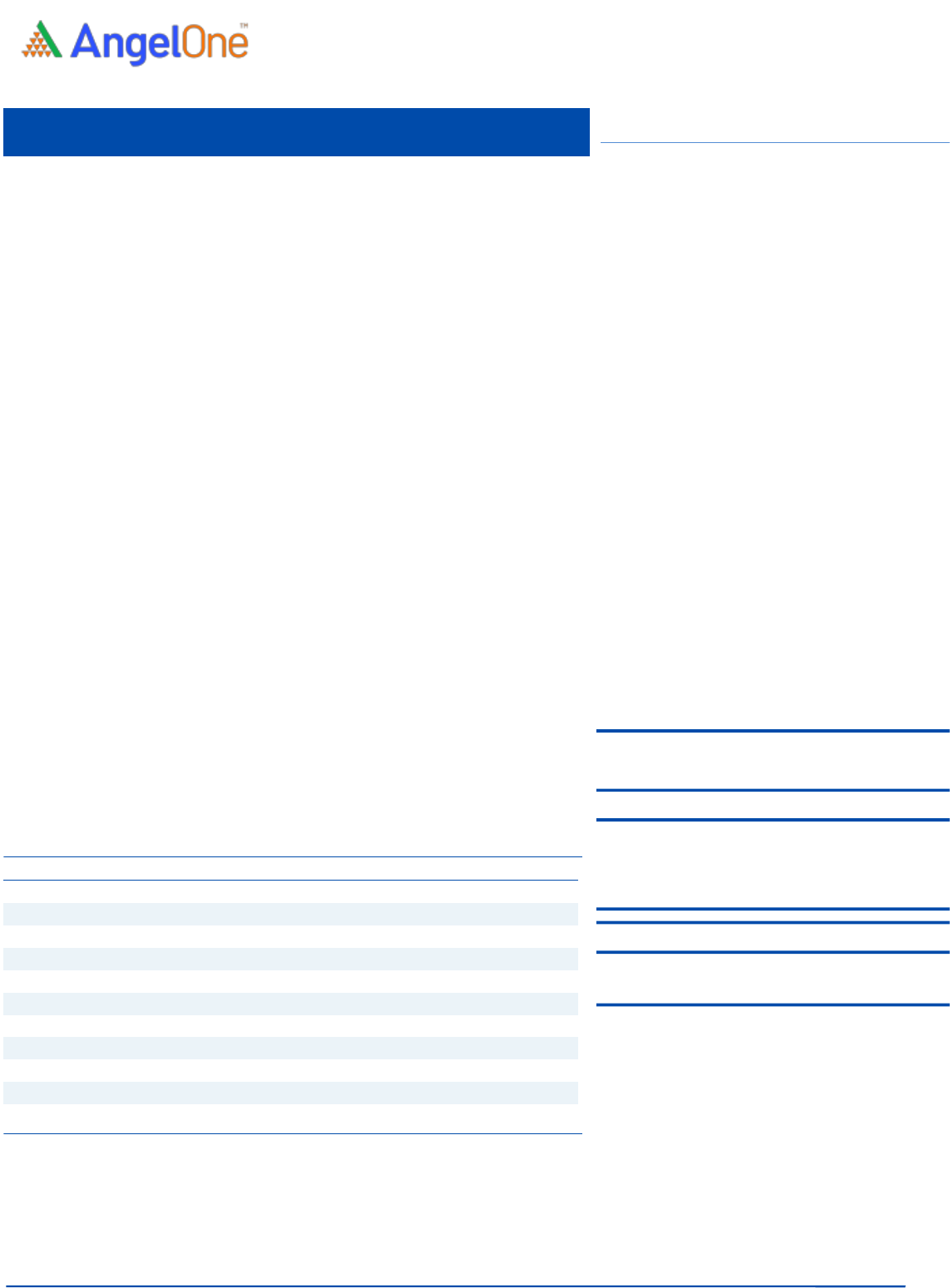

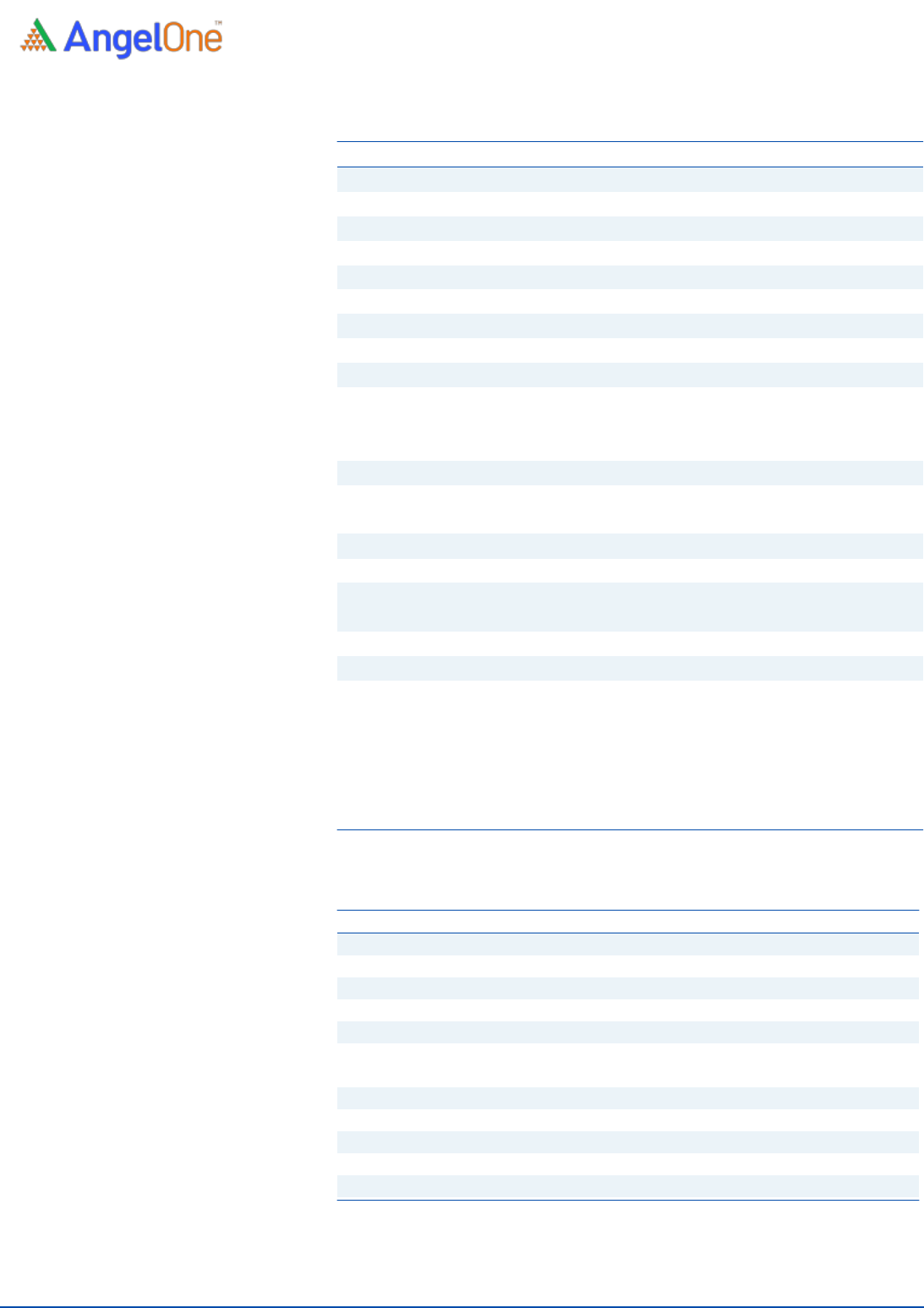

Key Financials

Y/E March (₹ cr)

FY’20

FY'21

FY'22

Net Sales

485

386

424

% chg

-20%

10%

Net Profit

-16

3

52

% chg

1610%

EBITDA (%)

49

61

113

EPS (Rs)

-2

0.4

6.4

P/E (x)

-

960.3

55.5

P/BV (x)

9.6

9.5

7.3

ROE (%)

-5.3

1.0

13.2

ROCE (%)

2

5.7

14.1

EV/Sales

6.7

8.2

7.3

Source: Company RHP, Angel Research

NEUTRAL

Issue Open: December 12, 2022

Issue Close: December 14, 2022

Offer for Sale: ` 960cr

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 27.3%

Public 72.7%

Present Eq. Paid up Capital: ` 15.72cr

Fresh issue: ` 0cr

Post Eq. Paid up Capital: ` 15.72cr

Issue size (amount): ₹ 960cr

Price Band: ₹340 - ₹357

Lot Size: 42 shares and in multiple thereafter

Post-issue mkt. cap: *₹2,863cr - ** ₹3,006cr

Post Issue Shareholding Pattern

Promoters holding Pre-Issue: 28.44%

Promoters holding Post-Issue: 27.33%

*Calculated on lower price band

** Calculated on upper price band

Book Building

IPO NOTE

Sula Vineyards Limited

December 9, 2022

Sula Vineyards Limited| IPO Note

December 9, 2022

2

Company background

Incorporated in 2003, Sula Vineyards Limited is the India's largest wine producer

and seller as of March 31, 2022. The company also distribute wines under a

bouquet of popular brands including "RASA," "Dindori", "The source," "Satori",

"Madera" & "Dia" with its flagship brand "Sula" being the "category creator" of wine

in India. The company's business is broadly classified under two categories (i) the

production of wine, the import of wines and spirits, and the distribution of wines and

spirits (the "Wine Business"); and (ii) the sale of services from ownership and

operation of wine tourism venues, including vineyard resorts and tasting rooms (the

"Wine Tourism Business").

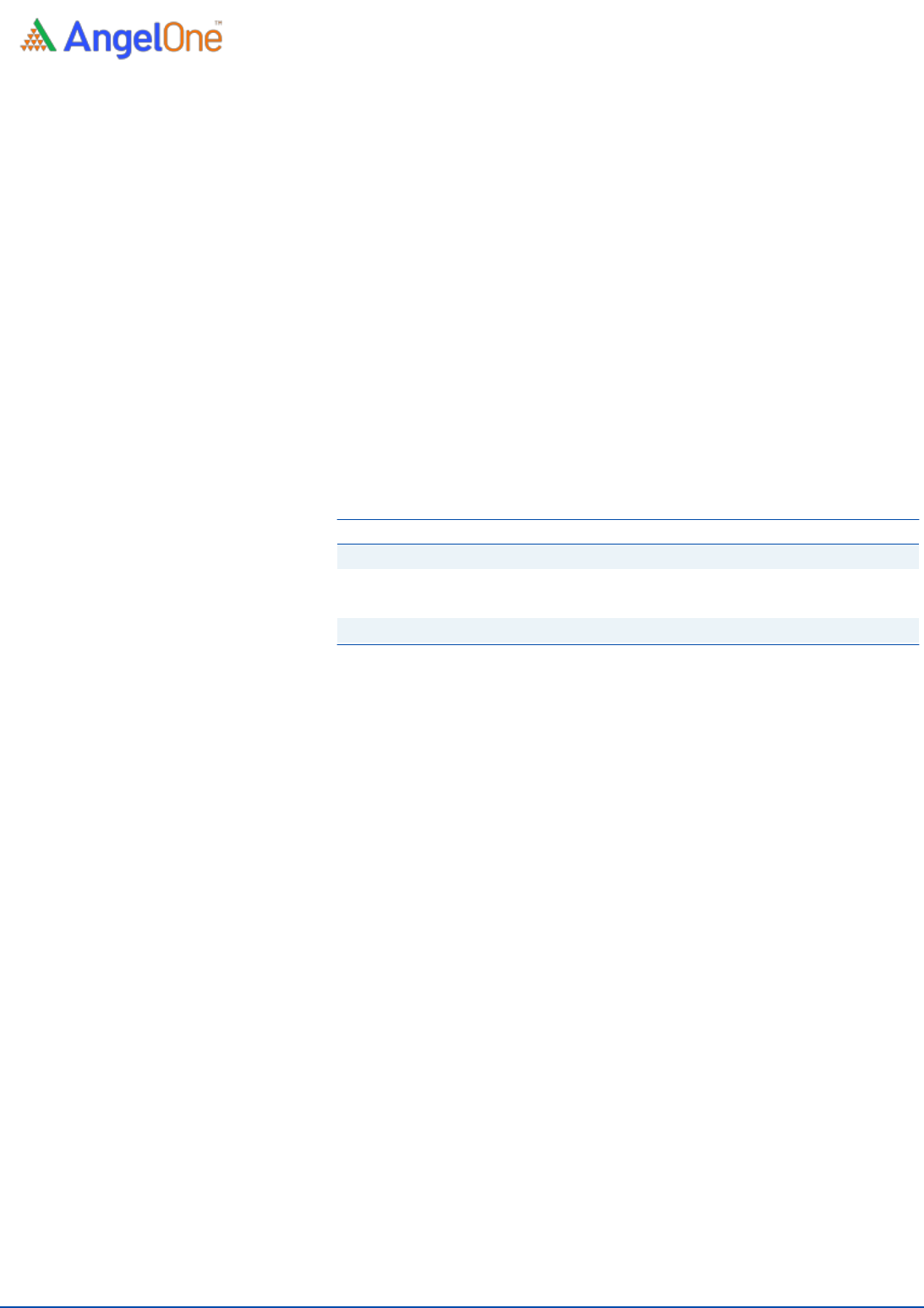

Issue details

The IPO is completely made up of offer for sale of ₹960cr.

Pre & Post Shareholding

(Pre-Issue)

(Post-Issue)

Particulars

No of shares

%

No of shares

%

Promoter

2,39,45,864

28.4%

2,30,08,661

27.3%

Public

6,02,52,884

71.5%

6,11,90,087

72.7%

Total

8,41,98,748

100.0%

8,41,98,748

100.0%

Source: Company, Angel Research

Objectives of the Offer

o The Objects of offer are to carry out the offer for sale of up to 26,900,530

equity shares, aggregating to 960.35cr by selling shareholders and to

achieve the benefits of listing the equity shares on the stock exchanges.

Sula Vineyards Limited| IPO Note

December 9, 2022

3

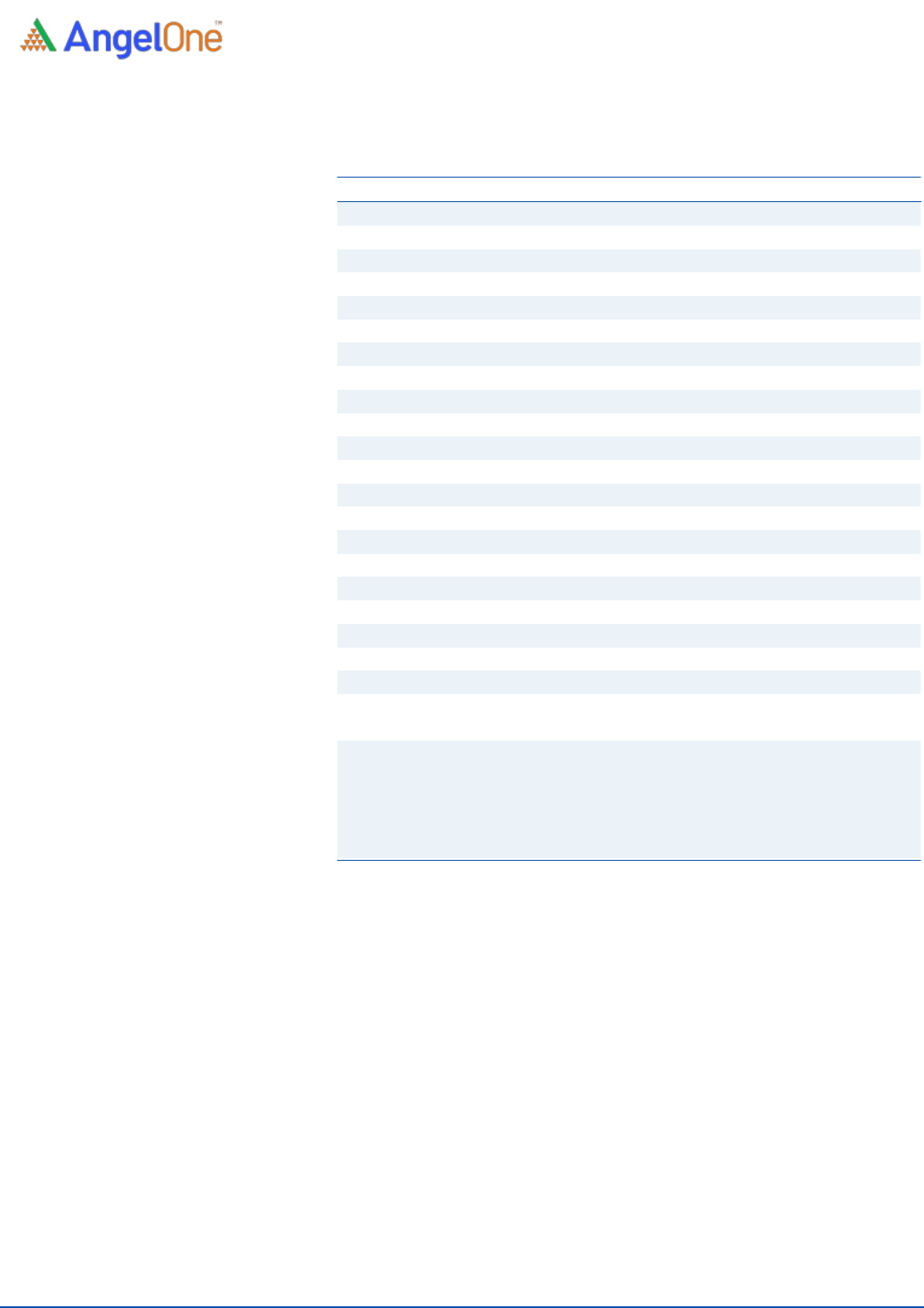

Financial Summary

Income Statement (Consolidated)

Y/E March (₹ cr)

FY’20

FY’21

FY’22

Net Sales

485

386

424

% chg

-20%

10%

Total Expenditure

436

325

311

Raw Material

227

157

117

Personnel

66

55

65

Others Expenses

143

112

129

EBITDA

49

61

113

% chg

25%

86%

(% of Net Sales)

10.1

15.8

26.7

Depreciation& Amortisation

35

26

24

EBIT

14

35

90

% chg

153%

154%

(% of Net Sales)

2.9

9.1

21.1

Interest & other Charges

33

33

23

Other Income

2

4

3

(% of PBT)

(9.0)

111.5

4.0

PBT

(17)

3

70

% chg

-118%

2083%

Tax

(1)

0

17

(% of PBT)

8.4

5.4

25.0

PAT

(16)

3

52

% chg

-119%

1630%

Share in profit of Joint venture

-

-

-

PAT

(16)

3

52

% chg

-119%

1630%

(% of Net Sales)

(3)

0.8

12.3

Basic EPS (Rs)

(2.0)

0.4

6.4

Fully Diluted EPS (Rs)

(2.0)

0.4

6.4

Source: Company, Angel Research

Sula Vineyards Limited| IPO Note

December 9, 2022

4

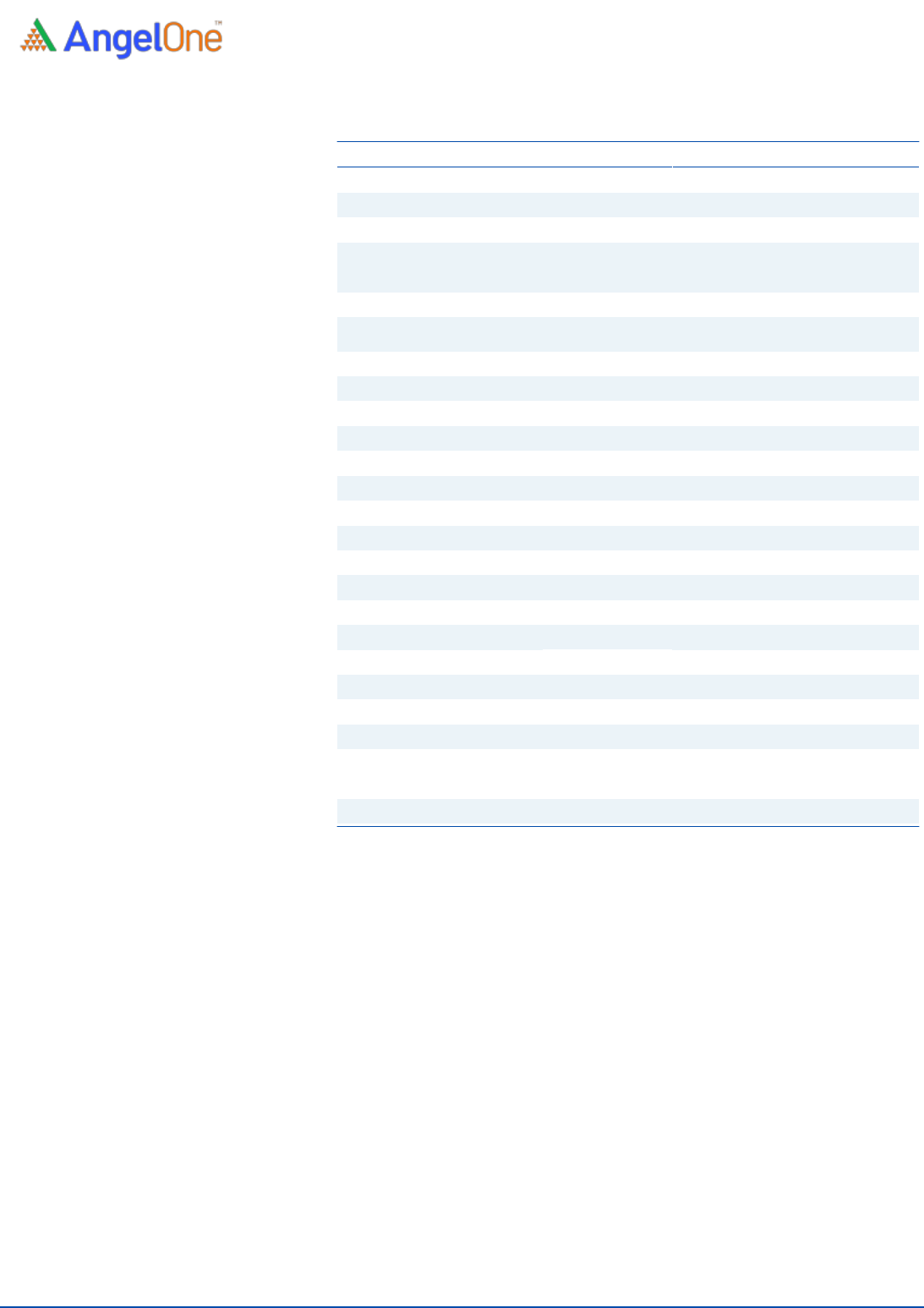

Balance Sheet (Consolidated)

Y/E March (₹ cr)

FY’20

FY’21

FY’22

SOURCES OF FUNDS

Equity Share Capital

15

15

16

Reserves& Surplus

285

290

380

Shareholders’ Funds

300

305

395

Minority Interest

2

-

-

Total Loans

393

315

240

Other Liabilities

8

10

2

Liabilities held for sale

14

Total Liabilities

703

643

637

APPLICATION OF FUNDS

Net Block

352

318

360

Goodwill

3

0

1

Capital Work-in-Progress

0

0

1

Investments

0

0

0

Current Assets

443

374

371

Inventories

171

144

162

Sundry Debtors

152

124

109

Cash

40

52

20

Loans & Advances

2

1

1

Other Assets

77

54

78

Current liabilities

110

92

105

Net Current Assets

333

282

266

Deferred Tax Assets (net)

0

0

0

Deferred Tax Liabilities (net)

18

16

17

Other Assets

33

27

26

Assets held for sale

32

Total Assets

703

643

637

Source: Company, Angel Research

Sula Vineyards Limited| IPO Note

December 9, 2022

5

Cashflow Statement (Consolidated)

Y/E March (₹ cr)

FY’20

FY’21

FY’22

Profit before tax

(17)

3

70

Depreciation

35

26

24

Change in Working Capital

2

48

-14

Interest / Dividend (Net)

30

29

19

Direct taxes paid

(11)

7

-17

Others

6

6

6

Cash Flow from Operations

45

120

87

(Inc.)/ Dec. in Fixed Assets

(45)

-16

-55

Movement in Bank Balances (Net)

(1)

(9)

0

Interest Received

1

2

2

Proceeds for sale of PPE and invesment in subsidiary

1

1

12

Payment pursuant to business combination

0

0

(16)

Other non-current investments

(0)

0

0

Cash Flow from Investing

(44)

(22)

(57)

Proceeds from Issue of Share capital

2

2

56

Proceed / (Repayment) of long term borrowings

19

(20)

-11

Interest Paid on lease liabilities

0

0

0

Payment of lease liabilities

(5)

(6)

-5

Interest / Dividend (Net)

(28)

(32)

-20

Proceed/ (Repayment) of short term borrowings

57

(39)

(61)

Dividend paid

(11)

0

(19)

Cash Flow from Financing

33

(94)

(61)

Inc./(Dec.) in Cash

34

3

-31

Opening Cash balances

3

37

41

CCE acquired in business combination

0

0

0

Transfer to assets of disposal group

0

0

0

Closing Cash balances

37

41

10

Source: Company, Angel Research

Key Ratios

Y/E March (₹ cr)

FY’20

FY'21

FY'22

Valuation Ratio (x)

P/E (on FDEPS)

-

960.3

55.5

P/CEPS

151.3

100.8

38.2

P/BV

9.6

9.5

7.3

EV/Sales

6.7

8.2

7.3

Per Share Data (Rs)

EPS (Basic)

-2.0

0.4

6.4

Cash EPS

2.4

3.5

9.3

Book Value

37.3

37.6

48.8

Returns (%)

ROE

-5.3

1.0

13.2

ROCE

2.0

5.7

14.1

Source: Company, Angel Research;

Sula Vineyards Limited| IPO Note

December 9, 2022

6

Research Team Tel: 022 - 40003600 E-mail: [email protected] Website: www.angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager

and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with

SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its

associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such

investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to

in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an

investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment

banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of

business. Angel or its associates did not receive any compensation or other benefits from the companies mentioned in the report or third party

in connection with the research report. Neither Angel nor its research analyst entity has been engaged in market making activity for the subject

company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage

that may arise to any person from any inadvertent error in the information contained in this report. Angel One Limited has not independently

verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express

or implied, to the accuracy, contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable

basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed

or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.